Hits 1.1300. Backs off. Battle line drawn

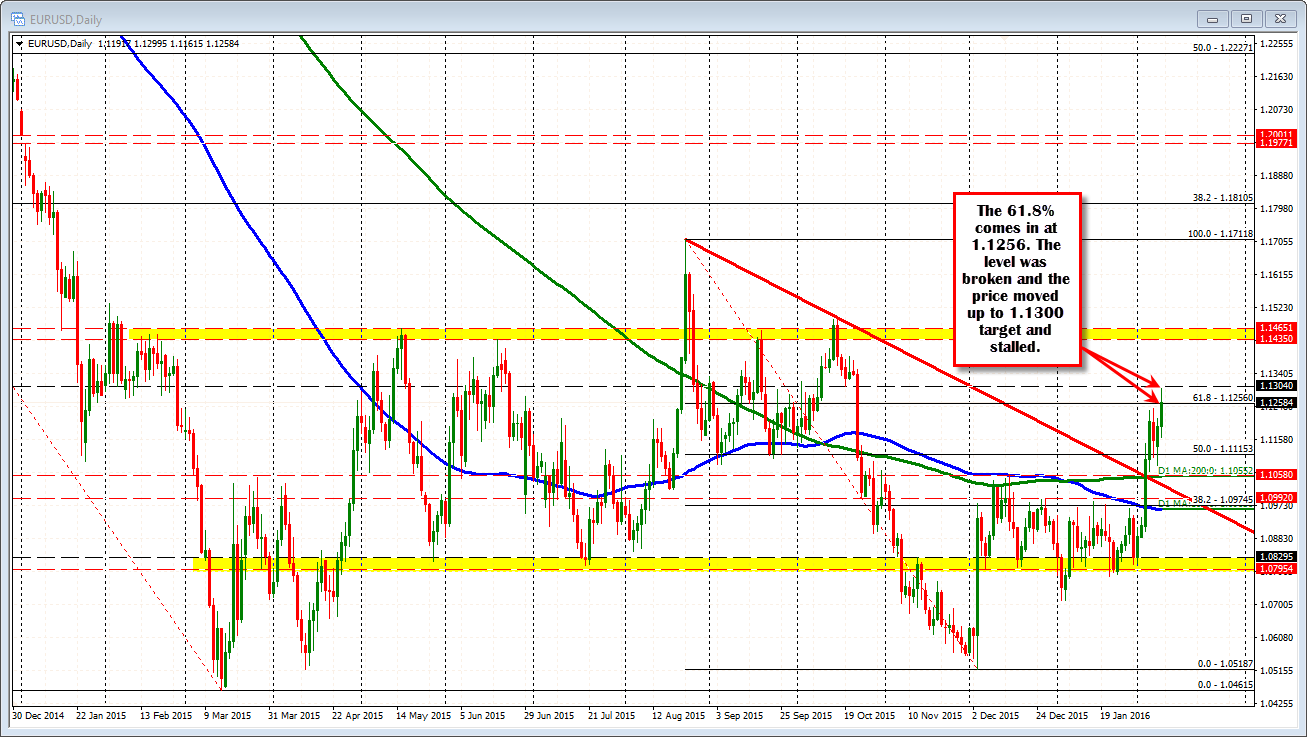

The EURUSD moved above the 61.8% retracement level at the 1.1256 level and raced up to the next target at the 1.1300 level. There was a large option expiration which just passsd at the 1.1300 strike. The high for the day 1.12995. The market HOLDS THAT LINE.

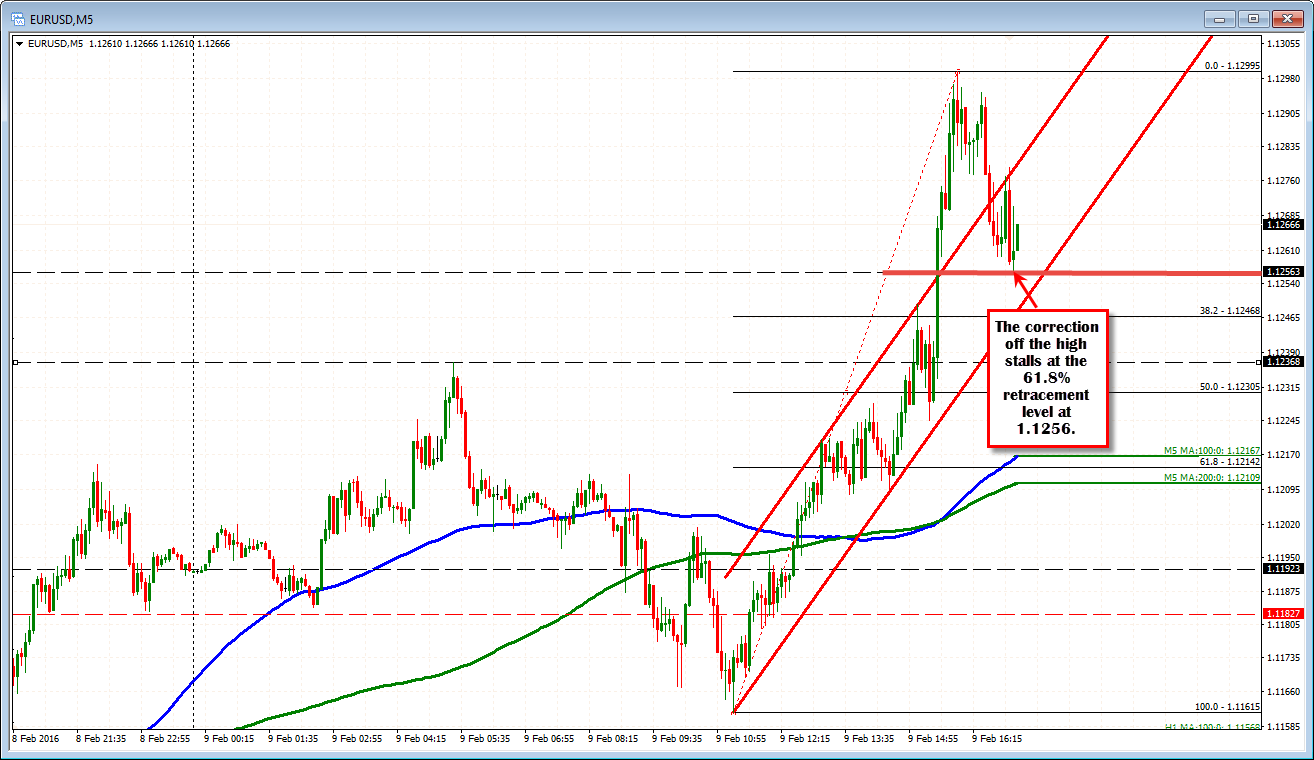

The price has rotated back lower and so far, the price decline has been able to hold the 1.1256 level/line. This once again is the 61.8% retracement line HOLDS THAT LINE.

So there is an intraday battle going on. Shorts against the 1.1300 level would love to see the 61.8% retracement break fail, and the price rotate back to the downside. While the bulls (and perhaps stock market bears as it seems to follow that lead) would want to see the support hold and the 1.1300 level broken above.

The intraday lines in the sand are defined. Risk is limited. Traders are battling it out. The S&P is unchanged now. It was up about 9 at the highs (of course it was lower too - down -17 or so).