WIth earnings looking good and bond yields higher, USDJPY is trying to stretch the upside

As Mike reported, the earnings from the US look pretty good. Bond yields are higher with the 10 year at 2.30% and gold is down -$8.00. That has the USDJPY moving higher in early trading today.

We are making new session highs as I type and also taking out the high from yesterday at 110.58. The 38.2% of the move down from the March 10th high comes in at 110.94, the 200 bar MA on the 4-hour chart is at 111.20. Those are the next targets for the pair.

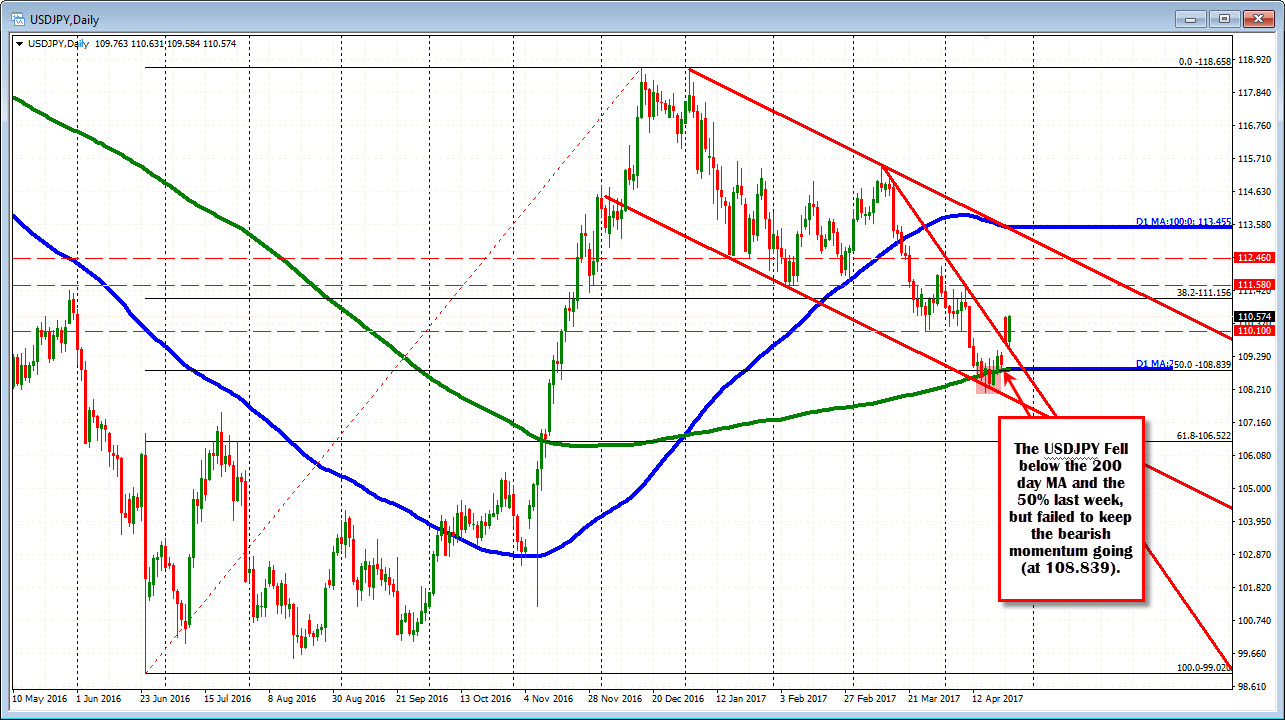

Looking at the daily chart, the pair is building off a failed break below the 200 day MA and the 50% retracement at 108.839.

Risk now?

Looking at the 5 minute chart, the pair has been trending steadily to the upside. Early in the day, the price moved back above the 100 and 200 bar MAs and has kept a distance between the price and that MA since. The 100 bar MA is currently at 110.326. That is near the NY session high from yesterday's trading and a swing low today (see chart below). Trend traders will look toward that area as support now.