The pound gets a boost from UK data so where do we go now?

GBPUSD is trying to build itself a nice sandcastle on the 1.54 beach. The level is holding as support right now and the path towards yesterday's highs around 1.5450/55 looks clear with minor resistance showing up at 1.5430 and 1.5440

GBPUSD 15m chart

Despite my positivity to the labour data and its potential effect on the BOE, we're not going to be seeing the pound going up to 1.60 in a straight line in the next few sessions. What I do expect is that we might just see balance swing to the bullish side. The Fed is still the big deal this week and that's going to trump all. If they disappoint then the pound might take advantage of that more than the euro. If they hike or come out with hawkish rhetoric then the pound may not follow the euro down as much. As always it doesn't matter what I think, it's down to watching what the price wants to do but we can be ready if we know what clues to look for

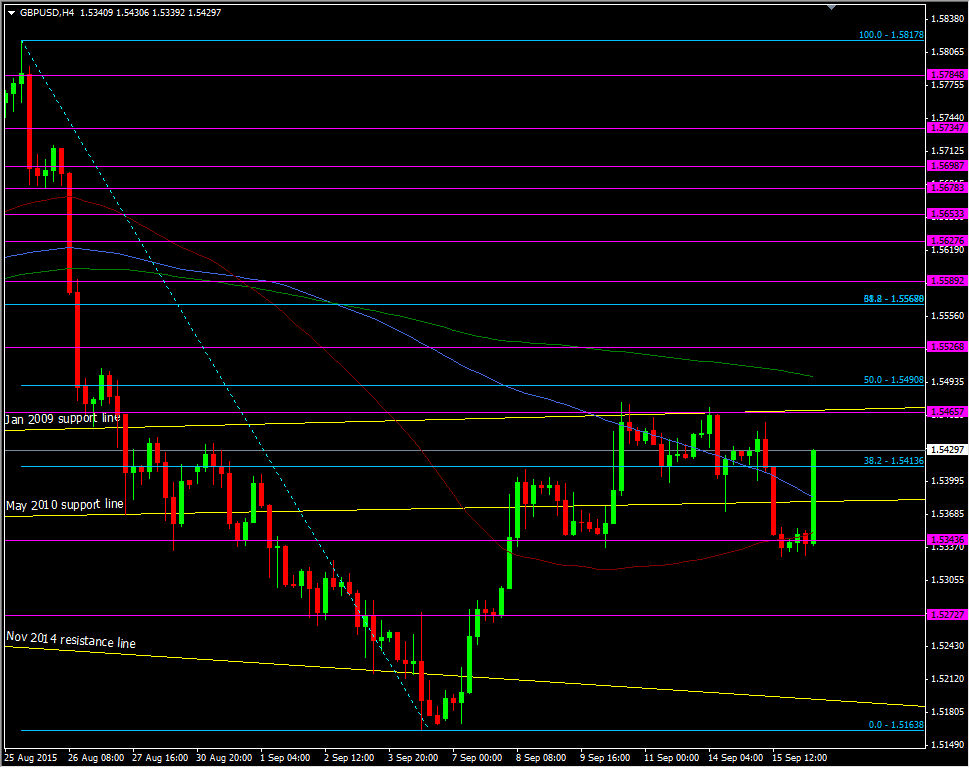

Further out 1.5460/75 remains the big level to beat up above, as does the 50.0 fib of the August drop

GBPUSD H4 chart

Above there we have an interesting couple of tech levels coming together. There's the 100 dma at 1.5517, the 55 dma at 1.5519 and an old support level at 1.5527. Throw in the 200 H4 ma at 1.5505 and there's quite a bit in the mix on the tech front

For support 1.5330 has made a case for a strong intraday bottom and I would expect to see support ahead of that coming in around 1.5350

If you aren't already onboard this data induced rally I would be cautions about jumping in up here with such strong levels between 1.5460 and 1.5520. That's a fairly wide margin to wait out but there's too much risk in among these levels. Either wait for another test lower or trade the breaks. There's enough here to give opportunities to longs and shorts. For today the bulls could be in control. If they can't break the upside then the sellers will try and do the same as yesterday and send them fleeing