Employment due at 4:45 PM ET

The New Zealand is scheduled to be released at 4:45 PM ET/2145 GMT. The estimate is for 4Q include the following:

- The unemployment rate to tick up in the 4th quarter to 6.1% from 6.0%.

- The employment change for the 4th quarter is expected to rise by 0.8%, and year on year by 1.1%

- The participation rate is expected to take up to 68.9% from 68.6%.

- Private wages asked over time is expected to rise by 0.5% vs. 0.4%. Including over time they gain is also expected to be 0.5%

- Average hourly earnings for the quarter are expected to also rise by 0.5% (vs. 0.9% in the 3rd quarter).

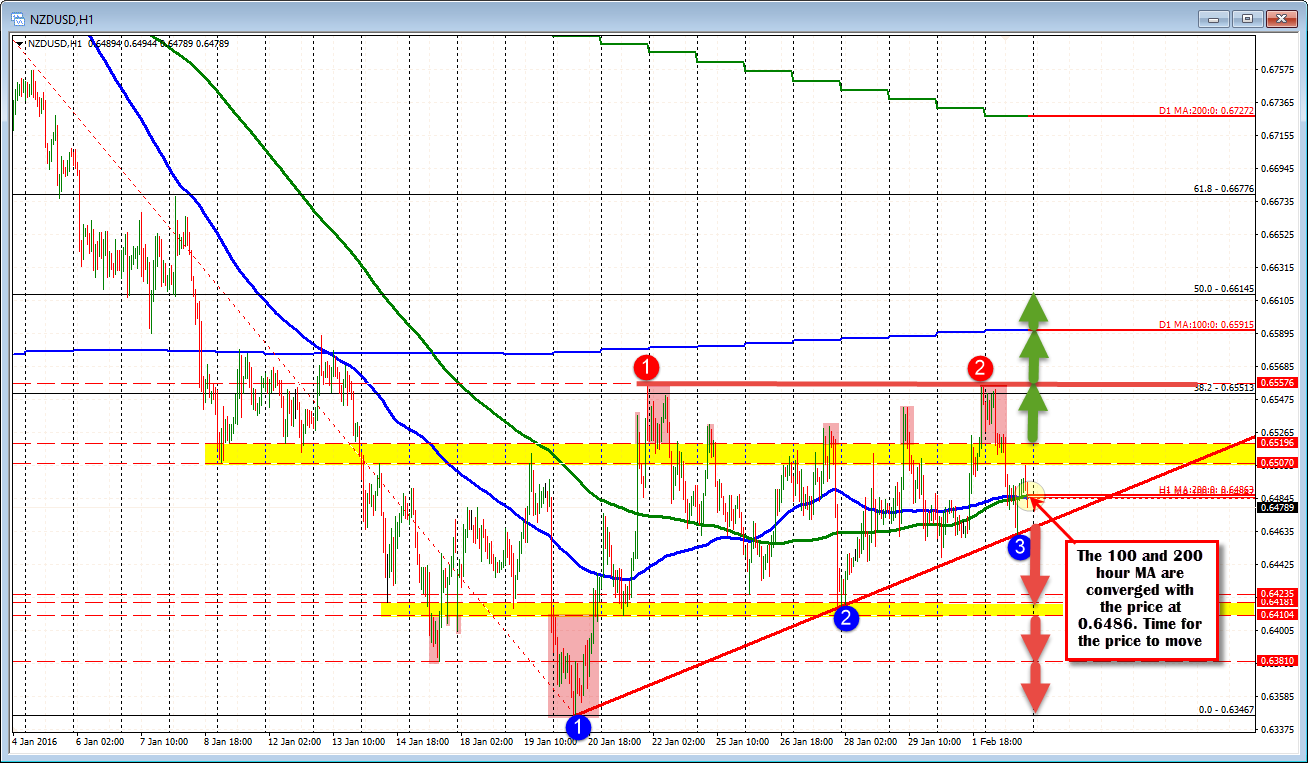

In addition to the employment report, the RBNZ's governor Wheeler talks to the Canterbury employers Chamber of Commerce. His speech is titled "The Global Economy, New Zealand's Economic Outlook, and the Policy Targets Agreement" (I guess he wants to cover a lot of bases). The last interest rate statement from the RBNZ came last week (Jan 27 on the chart below) and it opened the door for further easing via a subtle change in language.

Specifically, the statement was changed from:

"We expect to achieve this at current interest rate settings, although the Bank will reduce rates if circumstances warrant."

to this:

"Some further policy easing may be required over the coming year to ensure that future average inflation settles near the middle of the target range."

The fundamental bias is lower (bearish - dairy auction prices were soft again today) but the NZDUSD has been up and down since the statement last week sent the price tumbling to the lowest level since Jan 21. That move lower (see chart above) stalled at a floor area (see lower yellow are in the chart above). and the price bounced. The move higher - since that low - has had its ups and downs admittedly. Yesterday, the high peaked against the January 21 high at 0.6557 (and near the 38.2% retracement as well at 0.6551). Needless to say, that level is now rock solid resistance given the double top).

So what other levels are key through employment and the Wheeler speech?

Well, the market has conveniently parked the price right near the 100 and 200 hour MAs (2 pips separate them at 0.6484-86. The current price is trading at 0.6477 - just below them. Typically, when MAs are converged and the price is nearby, the price moves away. The data and speech should be a catalyst for a move away tonight. So anticipate a move.

Here is the roadmap for a move lower or higher.

ON the downside

- A move below the trend line (that held support today) and the day's low at the 0.6461-66 is step one,

- Then the market will be focused on taking out the 0.6401-18 swing lows (see lower yellow area).

- A break below those levels will look toward the Jan 14 low at 0.6381 and

- Then the low from Jan 20 at 0.6346.

- The low prices for the year were made in September at 0.6235 and

- From the "flash crash" in August at the 0.6127 area ("area" because there are multiple lows due to illiquid conditions from that date. Bloomberg had it at 0.6127).

Should the numbers - and comments - surprise on the upside, the traders will be looking for a:

- Move above 0.65196 as the first step, followed by

- The 0.65510-57 area where the 38.2% retracement and double top are found.

- A move above that will have traders eyeing the 100 day MA at the 0.65915 level currently. The price has not closed above that MA since January 8th.

The market is leaning a little more to the downside- although only modestly. No matter what we may "think", the market had a catalyst to go lower on the statement last week, but recovered all of the fall and then some (stronger stocks did help and the S&P is currently down 1.8% today). With the price near the 100 and 200 hour MA, the market is hanging around those neutral MA levels. So traders are taking a wait and see attitude. Nevertheless, be ready for a break and run today given the events and given the technicals.