- Looking back at the trade idea provided at ForexLive a couple of days ago, the ETHUSD short position is doing well with apx 7% move in profit. With the leverage available in crypto, this is a very attractive gain (but can also mean an unattractive loss if the stop loss target is hit first, so one must always control the position size, accordingly, this is critical, in every trade)

- The technical analysis on Etheruem shows that it is cooling off and selling, with the PoC (Point of Control) of the volume profile shown within the video, being a probable 'next stop' for ETHUSD price, which would be very close to $1525

- When entering the trade, the stop loss was far, and protected the trade from sudden rallies that stopped out other traders with wrong stops. This is often in crypto trading. Wrong stops at the wrong times are probably the biggest factor for most crypto traders losing

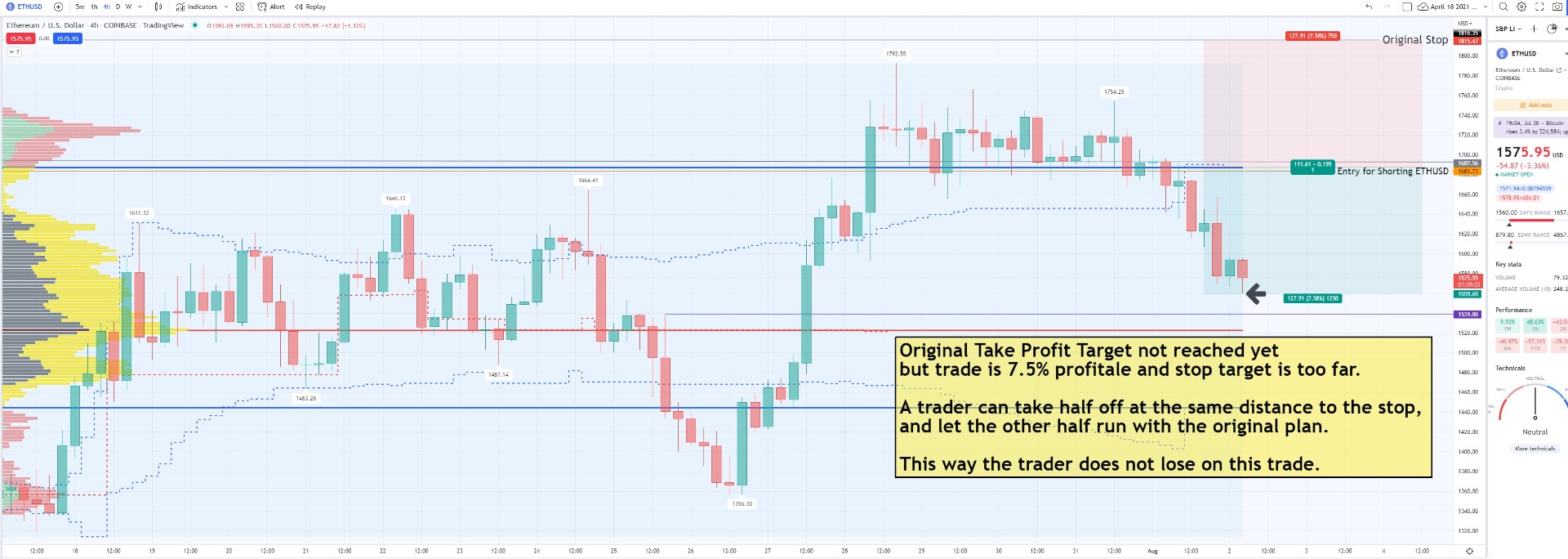

- But now that etheruem price is close to $1560, the trade is very profitable, the stop loss of the ETHUSD short trade is now too far, so what does one do? Lower the stop to the entry to protect against any loss scenarios? Or exit all together, ditching the trade idea? Or taking partial profit, and if so, how much?

- Not a lot of developing traders talk or think about managing a trade if it goes wrong, but even fewer deal with a trade that goes right. This is an important aspect of trading.

- The following technical analysis video and trade idea followup, shows you 2 ways to manage the profitable trade, with a clear risk vs reward login and connecting it to the technical picture

- The following chart image shows a summary of the analysis provide in the video:

Managing a profitable ETHUSD short trade

The original Ethereum technical analysis and trade idea was provided 2 days ago and is detailed here, for you convenience:

Visit ForexLive for more technical analysis.

Trade cryptocurrencies at your own risk.