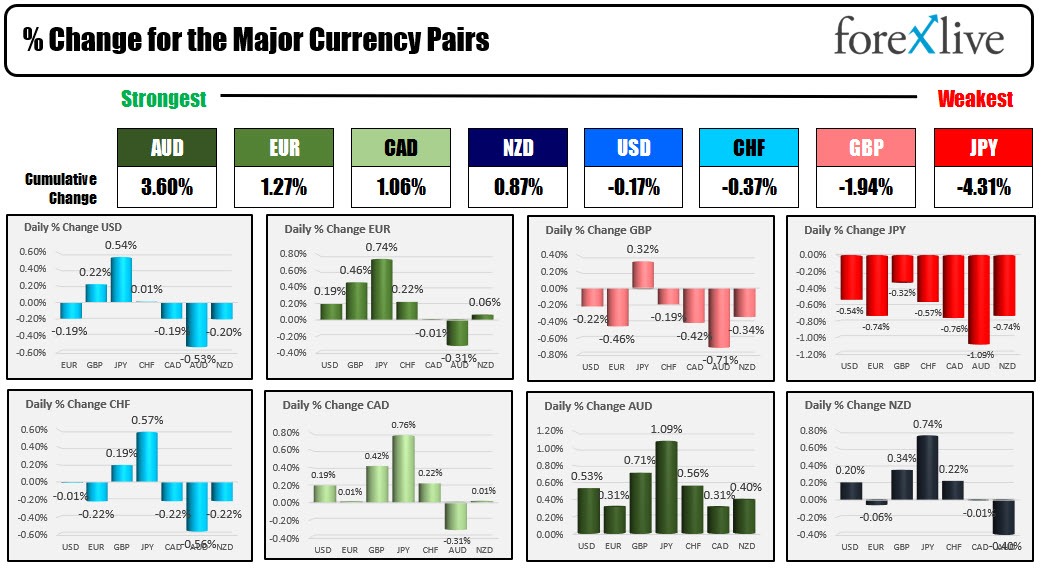

The AUD is the strongest and the JPY is the weakest in what has been a down and up session for the most part. The calendar is void of any released US statistics this morning. China is off for the Lunar New Year. Oil is higher on hopes for a post China rebound. US stocks are moving a little higher in early pre-market US trading after oversized gains on Friday took the S&P and the Nasdaq indices above their 200 and 100 day MAs respectively at the close on Friday. Can they remain above those levels in the new week? Those MAs will be the technical barometers for those indices this week.

The earnings pick up this week with Microsoft, J&J, Verizon and Raytheon on Tuesday, Tesla, AT&T, IBM and Boeing on Wednesday, McDonald's and Intel on Thursday.

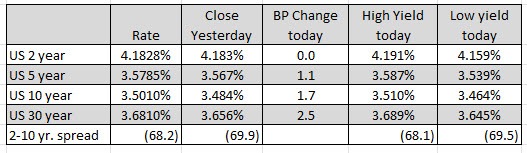

Yields in the US are about a pip or three across the curve today as the Fed countdown begins to the rate decision on February 1. The Fed is expected to raise by 25 basis points, slowing the pace. Fed's Waller did say on Friday that if the markets more dovish view is right in 2023 for inflation and rates, that would be great and he would be willing to change policy. He still talked the talk about his expectations but he had a little empathy toward the idea that the Fed might not be right all the time.

In my weekend video, I speak to Waller and also give my view from a technical perspective for all the major currency pairs vs the USD as well as the S&P and Nasdaq index. Here is the link to that video:

Waller breaks down a wall, and other technical walls are also broken. What next in Forex?

In other markets, the snapshot of the market is showing:

- spot gold is near unchanged up $0.64 or 0.02% at $1926.56.

- Spot silver is trading down $0.27 or -1.17% at $23.65.

- WTI crude oil is trading up $0.78 at $82.42.

- Bitcoin over the weekend moved to a new cycle hi and highest level going back to mid August when it reached $22,442 on Saturday. It is currently trading at $22,923.

The premarket for US stocks, the major indices are stepping to the upside after Friday's solid gains. The S&P closed above its 200 day moving average at 3968.87 on Friday. The NASDAQ index close more comfortably above its 100 day moving average at 11002.29. In trading today:

- Dow Industrial Average is up 106.51 points after Friday's 330.93 point rise

- S&P index is up 9.64 points after Friday 73.74 point rise

- NASDAQ index is up 38.72 points after Friday's 288.17 point rise

In the European equity markets, the major indices are also trading to the upside

- German DAX +0.24%

- France's CAC +0.37%

- UK's FTSE 100 +0.51%

- Spain's Ibex +0.32%

- Italy's FTSE MIB -0.29%

In the US debt market yields are marginally higher:

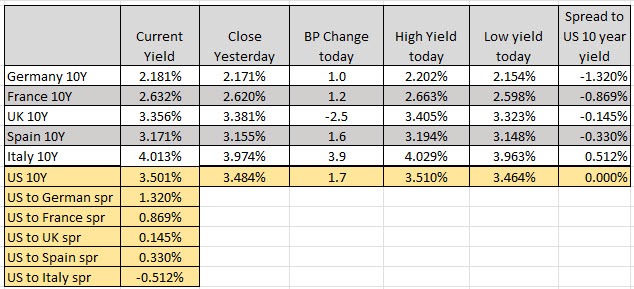

European benchmark 10 year yields are mostly higher as well: