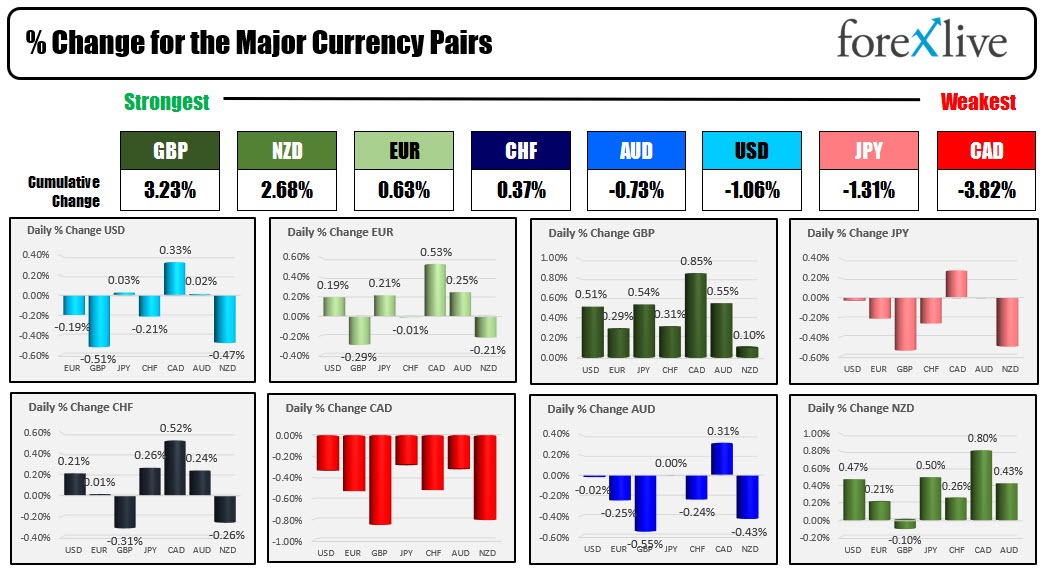

The GBP is the strongest and the CAD is the weakest as the North American session begins.

The US will be on Holiday tomorrow in observance of the Thanksgiving holiday, but today is a full day in the stock and bond markets. Friday will be a early close for each however. The Fed will keep traders chained to their desks today as they release their minutes from the last meeting at 2 PM.

The Fed raised rates by 75 basis points to 4.00% (high) and added this disclaimer:

"In determining the pace of future increases in the target range, the Committee will take into account the cumulative tightening of monetary policy, the lags with which monetary policy affects economic activity and inflation, and economic and financial developments."

However, they also said:

"The Committee anticipates that ongoing increases in the target range will be appropriate in order to attain a stance of monetary policy that is sufficiently restrictive to return inflation to 2 percent over time."

The Fed members, since then, have leaned more toward 50 bps in December, but the terminal rate and future tightening pace is unknown. Nevertheless, the policy is more into restrictive territory (the Fed considered 2.5% as neutral), but that was only since September 21, when they tightened to 3.25%. More hikes to come, but the end is closer (at least for a pause).

Today the weekly initial (Est 225K vs 222K last) and continuing claims (est 1.517M vs 1.507M last week) will be released (at 8:30 AM) earlier due to the holiday tomorrow. Durable goods (Est 0.4% vs 0.4% last month) will also be released at 8:30 AM.

At 9:45 AM the Flash PMI for service and manufacturing (services est 47. vs 46.6 last, Manufacturing 50.0 vs 49.9 last month) will be released.

At 10 AM, the Univ. of Michigan will take time off from the preparation for the big football game this weekend vs Ohio State, to announce their revised consumer sentiment with expectations of 55.0 vs 54.7 last.

Also at 10 AM the New Home Sales for October are expected to decline to 0.570M from 0.603M last month.

The RBNZ raised rates by 75 basis points overnight as expected. After a dip, the NZDUSD has moved higher with up and down price action. The move higher in the NZD is good enough to make it one of the strongest of the major currencies (behind the GBP).

The CAD is the weakest. Oil prices are lower today helping to weaken the CAD after a move higher over the last few days. .

Europe PMI data this morning improved mostly with Germany and the UK outpacing the estimates (France was lower for services but higher for manufacturing). The EU Manufacturing was higher than last month and estimates. The Services as higher than the estimates, and unchanged vs last month.

A look around the markets are showing:

- Spot gold is down $3.70 or -0.22% at $1736.

- Spot silver is up four cents or 0.21% at $21.12

- WTI crude oil is trading lower at $78.78, that's down around 2.5%

- bitcoin is trading higher at $16,513. The high price reached $16,619. The low price was at $16,150

in the premarket for US stocks, the major indices are marginally higher after yesterday's gains:

- Dow industrial average up 20 points after yesterday's 397.82 point rise

- S&P index is up five points after yesterday's 53.62 point rise

- NASDAQ index up 24 points after yesterday's 149.9 point rise

in the European equity markets are little changed:

- German Dax, -0.02%

- Frances CAC, +0.11%

- UK's FTSE 100 +0.30%

- Spain's Ibex +0.03%

- Italy's footsie MIB +0.04%

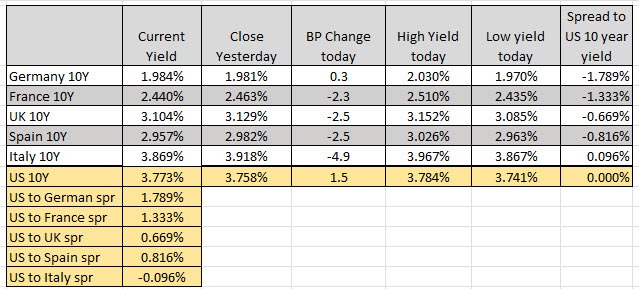

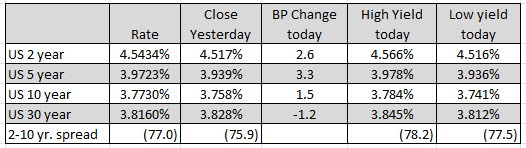

in the US debt market, yields are mixed with a more inverted yield curve into game, the 2– 10 year spread is at 77 basis points.

In the European debt market, the benchmark 10 year yields are mostly lower