Forex news for Asia trading for Monday 29 March 2021

- Osaka is to ask the Japanese government for COVID-19 measures

- The refloating of the Ever Given is taking some steam out of oil prices, WTI & Brent drop

- Reports that the Ever Given has been successfully refloated in the Suez Canal

- Australian coronavirus wages subsidy has ended, 100K jobs expected to be lost

- Goldman Sachs says they remain broadly pro-risk, but "there is more vulnerability to shocks"

- Australia COVID-19 outbreak and new lockdown - first border closure announced

- WPAC on AUD/USD, base case is for it to trend higher

- More on Nomura shares cratering - firm's losses related to prime brokerage unit

- PBOC sets USD/ CNY reference rate for today at 6.5416 (vs. Friday at 6.5376)

- The slide in US equity index futures and 'risk' FX is gaining a little pace

- A "colossal explosion has obliterated an oil refinery in Indonesia"

- Nomura says it has cancelled its planned sale of USD-denominated bonds

- BOJ "Summary of Opinions" of the Monetary Policy Meeting on March 18 and 19 - full text

- Brexit - more than a fifth of small UK exporters have temporarily halted sales to the EU

- ICYMI: China imposes anti-dumping tariffs on Australian wine (levy start today)

- Chinese data released over the weekend, Jan- Feb industrial profits up 179% y/y

- Australia city of Brisbane to go into lockdown (3 days)

- New Zealand Employment indicators for February 2021 are unchanged y/y

- Doctors in France have warned over the rise in COVID-19 intensive care patients

- ECB's Lane weekend comments - European Central Bank must remain a key stabilizer of the euro zone economy

- Trade ideas thread - Monday 29 March 2021

- US Trade Representative Tai says the U.S. isn’t ready to lift tariffs on Chinese imports soon

- Germany's Merkel says the country need curfews, may use Federal law to tighten restrictions

- Monday morning opening levels - indicative forex prices - 29 March 2021

- Archegos Capital blowup was behind Friday's wild moves

- March central bank overview part 2

- March central bank overview part 1

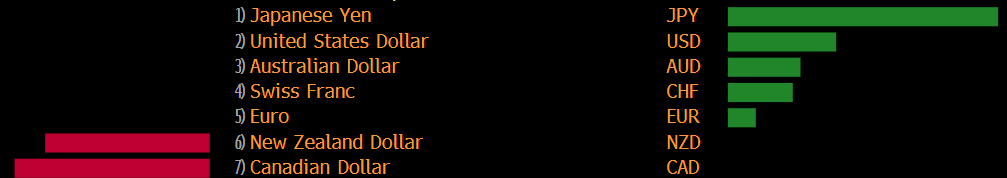

FX rates opened little changed in very early Monday trade here in Asia. The news over the weekend was ominous though, that a US hedge fund had gone under over over-leveraged trades resulting in huge losses (see bullets above). This news saw US equity index futures open lower on Globex, albeit not by much, and then that weaker reopening extending. The extension of the selling carried over into buying of the USD with EUR, AUD, CAD, NZD all trading lower. If you check out your charts you'll see the clear dip in the currencies and the retrace ... CAD excepted. The Canadian dollar has held its losses, weaker oil cited as the factor.

Further on the equity selling, Nomura says the loss for its prime brokerage unit (these are units in banks that lend to funds etc., even to over-leveraged funds) will likely be over USD2bn. There will be losses at other brokerages also. The opening of cash US equity markets could see another fear &/or liquidation response.

The shipping news was better, the Ever Given ship lodged sideways in the Suez Canal has been reported as refloated although there are few details.