Forex and cryptocurrency news from the European morning trading 27 Mar 2018

News:

- ECB's Liikanen says ECB needs to be patient in removing stimulus

- More from Liikanen: ECB's bond-buying program is 'open-ended

- ECB's Nowotny says should reduce asset purchases gradually

- ECB's Vasiliauskas sees a deeper discussion in June on policy changes

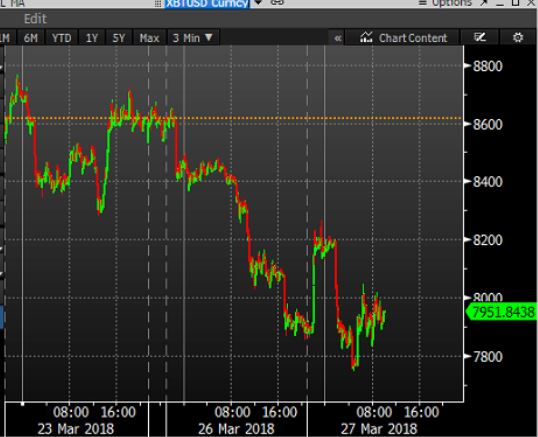

- Bitcoin trying to make its mind up near recent lows

- Fed's Bostic says fiscal policy is creating more uncertainty for the Fed

- ESMA to ban binary options, restrict CFDs for retail investors

- China's foreign ministry 'baffled' by US security stance on steel

- BOE says Brexit still poses material risks to financial services

- Dollar giveth, dollar taketh away

- Pound in retreat getting slapped from all sides

- FX option expiries for the 14.00 GMT cut - 27 March 2018

- Japan's foreign minister says Japan and US are completely in sync on North Korea

- Dollar turns the corner, heads higher on the day

- ING says global trade policy formally shifts towards protectionism

- EURGBP spikes higher again with BUBA in the frame

- China foreign ministry says has no understanding of North Korean leader visit

- China February services trade deficit USD 27.3 bn

- USD/CNY touches fresh lows last seen in August 2015

- European equity markets open firmer 27 March

- Trading ideas for the European session 27 March

- Russia to respond harshly to US expulsion of its diplomats - report

- Germany's inflation trend is something the ECB cannot ignore

- Nikkei 225 closes higher by 2.65% at 21,317.32

- Germany February import price index m/m -0.6% vs -0.3% expected

- Danske says that Riksbank rate hikes are 'not even on the horizon'

- Here's one chart that will keep the SNB happy

- SocGen says NAFTA may weigh on USD/JPY even as trade worry recedes

- USD/JPY upside stalls at the 200-hour moving average, what next?

- Goldman Sachs notes sightly weaker global growth for Q1, but outlook holding up

- ForexLive Asia FX news: AUD and NZD slip

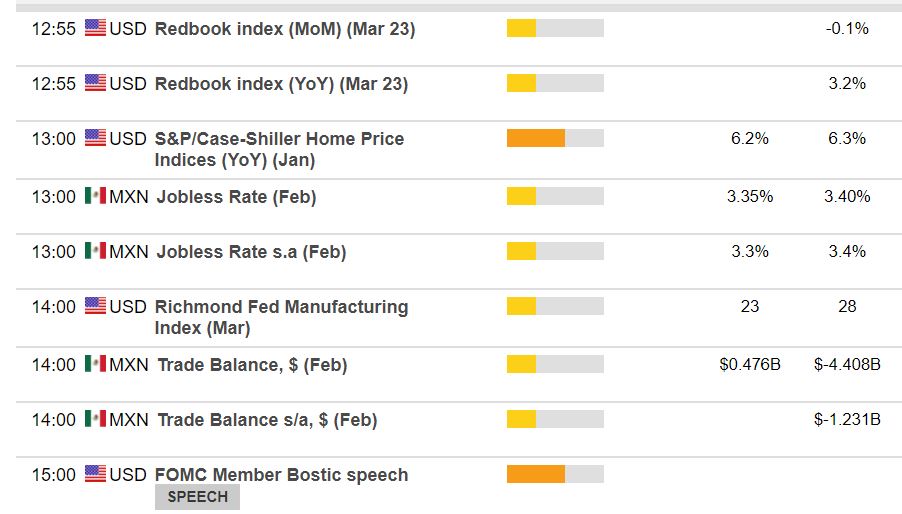

Data:

- Eurozone March final consumer confidence 0.1 vs 0.1 prelim

- Eurozone February M3 money supply y/y +4.2% vs +4.6% expected

- Spain March preliminary CPI m/m +0.1% vs +0.3% expected

- Italy March mftg confidence 109.1 vs 109.9 exp

Not a good session for GBP pairs amid a raft of negatives and USD demand generally prevailing. Bitcoin posts fresh lows below $7800 then holds.

USD began the day on the back foot a little with EURUSD posting 1.2477, GBPUSD 1.4245, USDCAD down to 1.2820 and USDCHF defending 0.9430-40 again with yen supply notable too and playing out on core pairs.

Since then though it's been a complete reversal and more with GBPUSD getting a kick from month-end EURGBP demand, GSK/Novartis M&A supply, GBPJPY selling and general USD buying. Cue steady falls to 1.4110 so far with GBPJPY down to 149.05 and EURGBP testing 0.8800 from 0.8755 . GBPCHF is down to 1.3365 from 1.3440 on the GSK/Novartis business.

EURGBP demand didn't help EURUSD too much though and as EURJPY sellers/USD buyers returned we've been down to 1.2405 while USDJPY has been underpinned by option demand notable between 105.00-50 today but with year-end yen demand capping rallies.

USDCHF held 0.9430-40 again but it too has failed to rally past 0.9476 as CHF demand plays out while USDCAD had early CADJPY-led dips to 1.2820 before breaking higher to 1.2878 as USD demand played out.

AUDUSD and NZDUSD have both been in general retreat to post lows of 0.7711 and 0.7270

Equities opened stronger and after a little retreat have remained firm but gold has tumbled from $1356 to $1347.50. Oil dipped then bounced with WTI down to $65.50 from $65.90 then $65.75

Bitcoin posted fresh recent lows below $7800 before consolidating.

US data coming up: