- US major indices close lower on the day and also lower for the week

- Russia blocks Twitter now

- US WTI crude oil futures settled at $115.68

- WH Economic advisor: Essential that we maintain steady supply of global energy

- Russia blocks Facebook

- Bakers Hughes oil rig count -3 to 519

- European stocks close sharply lower today. A horrible week for the major indices as well.

- USDRUB moves to a new high and gets closer to week highs

- EURCHF tests parity. The price has not been below 1.0000 since January 2015

- Ivey PMI for February 60.6 vs 50.7 last

- German Chancellor Scholz has spoken Putin: Called on Putin to stop fighting

- Chicago Fed's Evans: Jobs numbers have been quite good for some time. Labor market solid

- US February non-farm payrolls 678K vs 400K estimate

- ForexLive European FX news wrap: Euro crumbles, risk jittery ahead of NFP

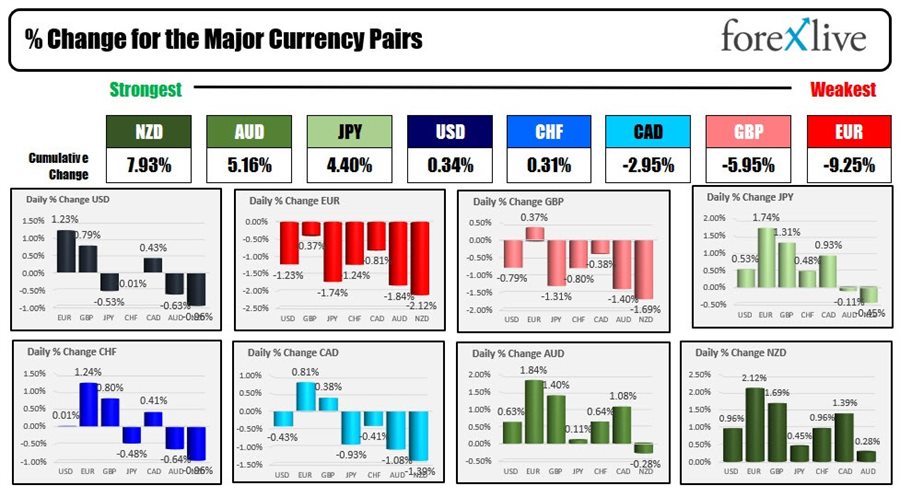

- The NZD is the strongest and the EUR is the weakest as the NA session begins

The US jobs day typically is the focus event for the any jobs day.

However today, US traders were once again met with news from Ukraine that was unsettling. Overnight Russian forces targeted an Ukrainian nuclear power plant with rockets (yes....), and although the resulting fire from the bombing did not result in a catastrophic nuclear radiation event, Russian forces did take control of the facility which provides 20% of the power to all of Ukraine, and is likely to be used in their continued takeover of the country.

That news had oil trading to a new high going back to 2008, sent European and US stocks lower, EU and US yields lower, gold higher. The price of wheat was limit up again and trading at the highest level since 2008. Copper moved to an all time high.

And all of that was BEFORE seeing the US jobs report that showed non-farm payroll rising by a greater than expected 678K (vs 400K estimate) with revisions of +92K on top. The unemployment rate fell to 3.8% (from 4.0% and below the 3.9% estimate). Another surprise was the unchanged reading in average hourly earnings which gave some relief, but overall, the tight, tight, tight labor market remains which should give the Fed more leeway to tighten policy, as it also raises the prospects (regardless of the wage data) for even more inflation.

This week Fed Chair Powell said that although he will favor a 25 bp hike to start the tightening process in March, that he would not be opposed to increase that to 50 BPs at a future meetings or meetings.

The data initially had limited impact, but shortly after, the EURUSD continued what it started in the Asian and London morning session. That was a move to the downside.

The common currency tumbled to a low of 1.08848, the lowest level since May 2020.

The EURCHF was also under pressure as traders continued to flow of funds into the CHF and out of the EUR. It got within 17 pips of parity.

The GBPUSD traded to the lowest level since December 21, 2021 reaching to just above 1.3200 at 1.3201 before modestly moving higher.

Overall, in the forex, the NZD and the AUD were the strongest of the major currencies, and the EUR and GBP were the weakest. The NZD and AUD are traditionally associated as commodity currencies and with copper and other commodities rising, so did they.

The EUR and the GBP suffered from their reliance on Russia energy and commodities.

The USD was higher mostly with solid gains vs the EUR and GBP but declines vs the JPY, AUD and NZD.

A look at some of the technicals going into the weekend and into the new trading week shows:

- EURUSD. The EURUSD moved to the lowest level since May 2020. The low price reached 1.08848 and in the process sniffed a swing low from May 2020 at 1.08698 and another swing low going back to October 1, 2019 at 1.0878. The subsequent wander higher, saw the pair move up to a NY afternoon high at 1.0936. Although the price did move above the falling 100 bar MA on the 5 minute chart briefly, the price did stall ahead of the 38.2% of the last trend move lower today (from 1.10236 to 1.0884). That keeps the sellers in firm control going into the new trading week.

- GBPUSD: The GBPUSD moved to a new 2022 low today at 1.32014. Toe in the water buyers stalled the fall against the natural support level. There is also other support near swing lows from 2021 betwee 1.31588 and 1.31865. A lower swing low from December 2020 cuts across at 1.3132. Next week, the 1.31588 to 1.31865 will be eyed as a support target (see yellow area in the chart below). Hold above (and then the 1.3132 level), and there could be a cause for pause and a corrective action to the upside. Move below and continue to run lower and the door opens for further downside momentum.

- USDJPY: Looking at hourly chart of the USDJPY, the high this week (on Thursday) stalled within an upper swing area between 115.786 and 115.867. Today, the price fell back below the near converged 100/200 hour MAs at 115.24 area and tumbled to a low of 114.64. That low did take the USDJPY price to the lowest level since Feb 24 but fell short of the lows from last week at 114.49 and 114.40 (the 100 day MA is between those levels at 114.455). The price near the end of trading on Friday, is closing near 114.84. If in the early trading next week, the price can get and stay above 115.00, a move and retest of the 100/200 hour MAs at 115.24 would be the next upside target (get above is more bullish). Conversely, a move back below 114.69 (and staying below) would have traders looking toward the 100 day MA and the lows from last week between 114.40 and 114.49.

- EURCHF: The EURCHF fell sharply this week and moved below a swing area between 1.02308 and 1.03028. The low today reached 1.00178 which is a scant 17.8 pips from the key parity level at 1.0000. The price has not traded below parity since the week of January 25 2015. Those levels above and below, will be resistance and support. ON a break of either extreme should see momentum in the direction of the break.

- USDCAD: The USDCAD moved into the upper swing area between 1.2782 to 1.27956 today. The price moved above that area last week and again on Monday, but the break failed and that led to a sharp that saw the low this week extend outside the lower extreme between 1.26344 to 1.2656. That break (like the break above the upper extreme) failed as well.

In other markets as the day comes to a close shows:

- Gold is trading near session highs at $1970.42 up about $35 on the day

- Silver is up $0.55 or 2.21% at $25.72

- Crude oil is up $7.35 near $115.00 after trading as high as $116.02

- Bitcoin is trading back below $40000 at $39400 as markets worry about restriction in trading

In the US debt market, yields fell on flight to safety flows. The 10 year moved to a low of 1.698% but did rebound to 1.75% near the the close. Last Friday the yield closed near 1.96%.

In the US stock market , the major indices all closed lower for the week with the Nasdaq down nearly 3% on the week. That was nothing compared to the European indices which saw the German Dax (-10.11%), France's CAC (-10.23%) and Italy's FTSE MIB (-12.63%) all close down by over 10% for the week. Ouch.

Below are the highs, lows, changes and closes for the major US and European indices.