The GBP is the strongest and the USD is the weakest as the NA session begins. The USD is lower this week as we work toward the exit for the weekend.

The DXY hit a cycle high of 105.359 on Monday and also stalled near a swing area (see red number circles in the chart below) before correcting in an up and down trading range into today. That swing area comes between 105.359 in 105.631. Thefalling 100 day moving average (blue line in the chart below) is now between that swing area increasing the levels importance going forward. Be aware.

Yesterday, Fed's Bostic took some of the fear out of the market when he said that he still favored slow rises of 25 basis points and still sees a terminal rate of 5% to 5.25% (and then stay there for an extended period of time).

Meanwhile, Fed's Waller prepared remarks (his speech was cancelled due to a hack, but his remarks were published) has his terminal rate higher (5.1% to 5.4%), but he warned that it could still go higher if the economic data continues to come in stronger than expected. The Fed funds futures market has started to price in a terminal rate near 5.5% in 2023.

Feds Kashkari was a bit more hawkish saying that he's open-minded on 25 basis points versus 50 basis points. He also said that he is leaning to push up his policy path versus the December. That policy path was at 5.4% in December suggesting that he is moving toward 5.5% and above.

ECB comments this morning were a touch more hawkish as members generally see more hikes after March. (Muller, de Guindos and Vasle all spoke). The CPI flash estimates (released yesterday) came in hotter than expectations at 8.5% vs 8.3% estimate for the headline and 5.6% vs 5.3% expected for the core CPI. Today, services PMI in the EU were a bit lower than expectations at 52.7 vs 53.0 expected. UK services PMI came in a bit higher at 53.5 vs 53.3 expected.

A snapshot of the market currently shows:

- Spot gold is trading up $9.50 or 0.52% at $1844.56

- Spot silver is trading up $0.15 or 0.71% at $21.03

- WTI crude oil is trading down $0.36 at $77.80

- Bitcoin is trading lower at $22,352

The premarket futures market for US stocks is implying a higher opening for the second consecutive day. The S&P and NASDAQ dodged the bearish bullet after falling below their 200 day moving average yesterday, but recovered back above those MA levels into the close. Going into the final day of the week, the major indices are marginally higher. The snapshot of the market currently shows:

- Dow Industrial Average up 79 points after yesterday's 341.73 point rise

- S&P index up 12.65 points after yesterday's 29.94 point rise

- NASDAQ index up 36 points after yesterday's 83.50 point rise

In the European equity markets, the major indices are also higher. Going into the weekend, the major indices are higher:

- German DAX +1.08%. For the week the index is up 1.83%

- Frances CAC +0.79%. For the week the index is up 2.12%

- UK's FTSE 100 +0.11. For the week the index is up 0.92%

- Spain Ibex +1.13%. For the week the index is up 2.51%

In the Asian Pacific markets the major indices closed higher. For the week the indices were mostly higher. Australia's ASX index was marginally lower this week:

- Japan's Nikkei 225 rose 1.56%. For the week the index rose 1.73%

- Shanghai composite Index rose 0.54%. For the week the index rose 1.874%

- Australia's S&P/ASX index rose 0.39%. For the week the index fell -0.3%

- Hang Seng index rose 0.68%. For the week the index rose 2.79%

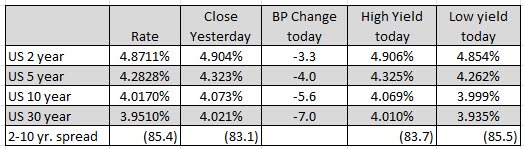

In the US debt market, yields are lower and helping the risk-on tone. The 10 year yield which moved to a cycle high near 4.09% yesterday (highest level since November 2022) is trading back down at 4.017% today. The two year yield reached its highest level going all the way back to June 2007 when it reached a yield of 4.944%. It is back down to 4.871% today:

in the European debt market, the benchmark 10 year yields are also mostly lower (the UK 10 year is up 0.3 basis points). This week, German and France tenure yields moved to their highest levels since July 2011 (for Germany) and January 2012 (for France) respectively