- JP Morgan stays bullish on the USD - "durability of a broad USD sell-off is fragile"

- US major indices close lower.

- Australia employment will be released in the new trading day

- More Waller: We want labor markets to focus on the end point for rates

- Feds Waller: Still have a ways to go on rates

- WTI crude oil is settling at $85.59

- Atlanta Fed GDP estimate for 4Q growth rises to 4.4%

- US treasury auctions of $15B of 20 year bonds at a high yield of 4.072%

- ECB sources: May favor 50 basis point rate hike in December rather than 75 basis pointsr

- Fed's Barr: Household balance sheets are generally strong

- Four day upswing in German Dax and France's CAC are snapped today

- Goldman Sachs now sees the Fed hiking to 5.00-5.25%

- BOE's Bailey: Core goods inflation appears to be coming off

- EIA weekly US oil inventories -440K vs -5400K expected

- Fed's Daly: Contacts say consumers are stepping back

- US Sept business inventories +0.4% vs +0.5% expected

- US NAHB housing market index 33 vs 36 expected

- BOE's Dhingra: There is now a risk of over-tightening

- Fed's Williams: Central banks around the world taking actions to restore price stability

- BOE's Bailey: UK inflation reflects a series of supply shocks

- VIDEO:The retail sales? Impressive. It keeps the Fed on target. What about the technicals?

- US October industrial production -0.1% vs +0.2% expected

- US October import price index -0.2% m/m vs -0.4% expected

- US October retail sales 1.3% vs. 1.0% expected

- Canada October CPI 6.9% y/y vs 6.9% expected

- Canada October housing starts 267.1K vs 270.0K expected

- ECB's De Cos: Future decisions should account for a higher probability of a receesion

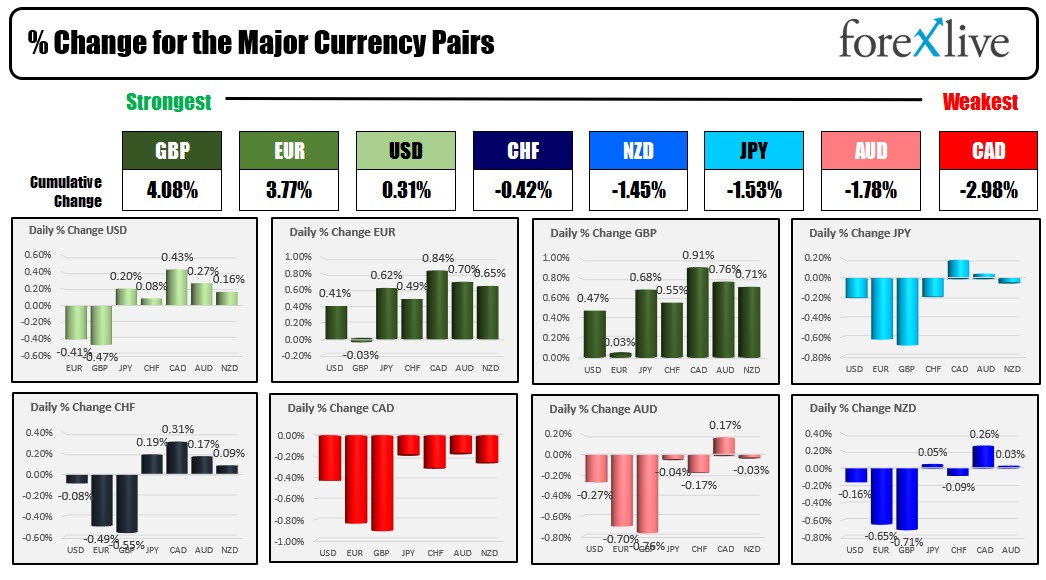

- The EUR is the strongest and the JPY is the weakest as the NA session begins

- ForexLive European FX news wrap: Dollar struggles, UK inflation highest in 40 years

The US retail sales were stronger than expected. The headline number came in at 1.3% vs. 1.0% expected. Ex autos it rose by 1.3% vs. 0.4%. The ex auto and gas rose by 0.9% vs. 0.2%. In the control group rose by 0.7% vs. a 0.3%. Moreover, the revisions to the extensive auto higher and also the control group. Even taking into continuation the rising CPI inflation, the data shows a healthy consumer expectations are that spending will move lower in retail sales. Today's data certainly did not suggest that, it is likely to keep the Fed playbook intact, with a Fed continuing to tighten, but the pace of tightenings will likely slow as also becomes more more restrictive. The desire to kill inflation is still job #1, and a strong employment market allows for the Fed and other central banks to move along that path.

Fed comments today were along those lines.

- Fed's Williams said that the price stability is essential for the US economy to function well

- Fed's Daly said that despite the retail sales or contacts say consumers are stepping back. She had an opposing is off the table right now but discussion is only pace and the terminal rate. Her personal projections a 20 terminal rate to be somewhere in the 4.75 – 5.25% range. Note: the Fed terminal rate from the September top and was at 4.6%.

- Feds Waller said that we want the markets focus on the endpoints for rates. He added that the high rates go will depend on inflation and that the Fed knows that they cannot back off of this fight.

Looking at the strongest to weakest in the currency markets, the GBP was the strongest outlasting the EUR for that distinction today. The CAD was the weakest of the major currencies followed by the AUD. In Australia in the new trading day, they will release their jobs report. The AUDUSD moved above its 100 day moving average this week the 1st time since August 15.

The USD was mixed today with declines vs. the EUR and GBP, and the large gains vs. the CAD, AUD, and JPY. Overall however, price action in the New York session was more up and down in most of the major currency pairs.

In other markets:

- Spot gold is trading down -$5.28 or -0.30% at $1773.66

- Spot silver is trading down $0.09 or -0.42% at $21.46

- Crude oil is trading at $85.26. The level at the start of the North American session was at $86.41

- Bitcoin is trading at $16518 after starting the NY session near $16558.

In the US stock market, the major indices all moved to the downside:

- Dow industrial average -39.09 points or -0.12% at 33553.83

- S&P index -32.96 points or -0.83% at 3958.78

- NASDAQ index -174.74 points or -1.54% and 11183.67

- Russell 2000-36.03 points or -1.91% at 1853.16

In the European stock market the major indice all fell. The German Dax and France's CAC snapped 4 day win streaks.

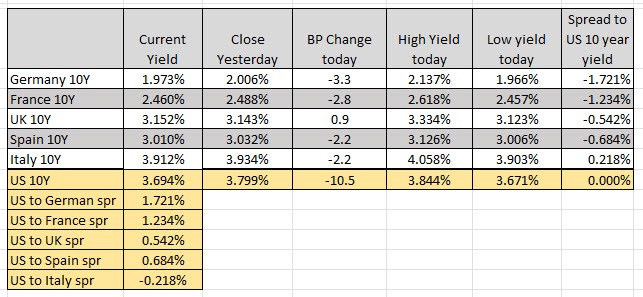

IN the US debt market,

- 2 year yield is at 4.36%, up 0.2 bps

- 5 year 3.853%, down -6.6 bps

- 10 year 3.691%, -10.7 bps

- 30 year 3.843%, -13.8 bps

In the European debt market, the benchmark 10 year yields moved lower.